2025 Cyber Security Vendor Transaction Highlights

- 467 total funding, M&A, IPO transactions

- $13.97 Billion raised over 392 rounds

- 73 total M&A events

- 2 IPOs

Crunching the Numbers

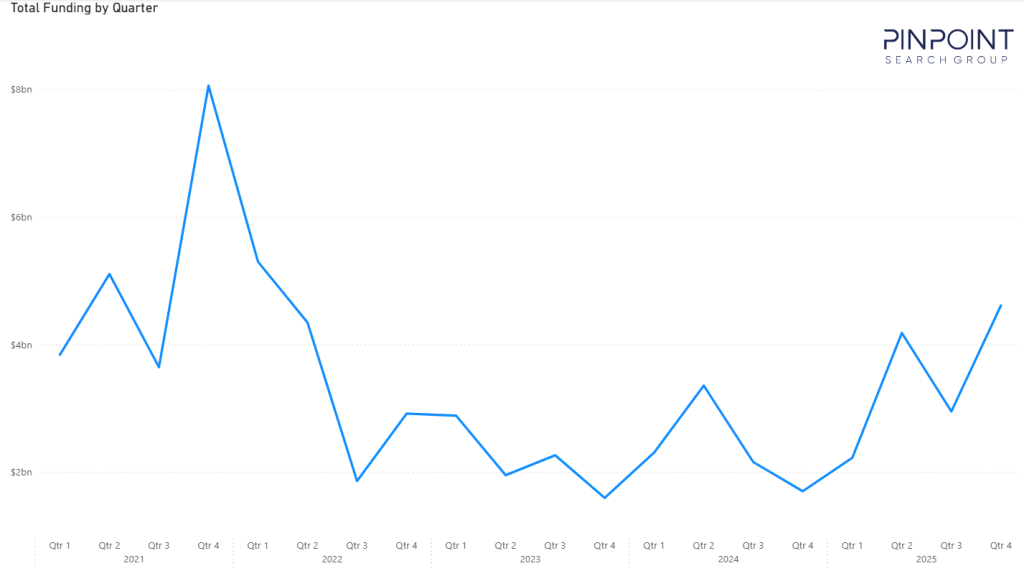

- The $13.97 Billion raised in FY 2025 represents a 47% increase in funding raised when compared to 2024 ($9.5B).

- Funding volume increased by 30% with 392 funding rounds tracked in FY 2025 compared to 304 in 2024.

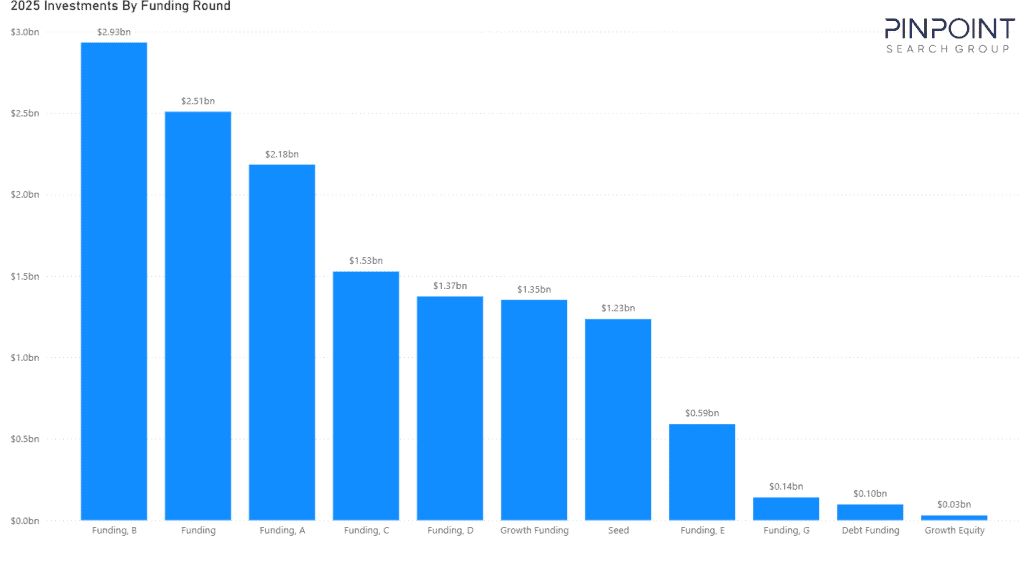

- Early-stage funding (Seed, Series-A) dominated in 2025 representing 63% of total funding volume.

- 30 funding rounds >$100M were recorded representing 49% of all investment dollars while accounting for 8% of funding volume.

Highlights and Analysis

In 2025, our team tracked a total of $13.97B in cybersecurity investment, marking a meaningful recovery from the funding trough experienced in 2023 and 2024. While still below the peak of 2021 ($20.6B), this level of capital places 2025 nearly on par with 2022 and firmly establishes it as the strongest funding year of the post-correction cycle.

The trajectory is notable: following the sharp contraction from 2021 to 2023, funding stabilized in 2024 and accelerated in 2025. This rebound is not the result of indiscriminate capital deployment. Instead, it reflects renewed confidence paired with higher selectivity, with investors concentrating capital into companies demonstrating technical depth, operational discipline, and relevance to evolving buyer priorities.

Early-stage companies continued to represent a substantial share of overall activity, but the defining feature of 2025 was the return of large, conviction-driven rounds. Growth and late-stage capital re-entered the market decisively, signaling that investors are again willing to scale platforms, provided the underlying fundamentals are clear.

Funding Overview

From a structural standpoint, 2025 funding activity underscores how different this recovery is from the last cycle. Capital is flowing, but it is doing so unevenly and intentionally.

Early-stage companies continued to represent a substantial share of overall activity. Seed and Series A rounds accounted for roughly two-thirds of all funding rounds recorded in 2025, reinforcing that company formation and experimentation remain healthy across the cybersecurity ecosystem. However, these rounds represented a significantly smaller share of total capital deployed.

Much of this early-stage activity appears to function as an innovation layer for the broader ecosystem, where a small number of companies ultimately scale independently while many contribute capabilities and technical perspective through platform acquisition.

By contrast, later-stage and growth rounds made up a minority of transactions but captured an outsized share of dollars raised. A relatively small number of large rounds accounted for a disproportionate percentage of total capital, reflecting investor preference for platforms that can consolidate spend, replace fragmented toolsets, or address risks that have moved decisively into the boardroom.

Founders raising capital in 2025 faced a more demanding bar around product clarity, market articulation, and go-to-market realism than in prior cycles. Capital was available, but it was selective.

The coexistence of robust early-stage formation and concentrated late-stage investment defines the current market. It is neither excessive nor defensive. It is disciplined.

Market & Macro Signals

Several macro trends help explain where capital flowed in 2025, and why.

AI adoption is outpacing governance and identity controls

Across enterprises, AI deployment accelerated rapidly in 2025. What emerged alongside that acceleration was a growing realization: governance, identity, and control frameworks are lagging far behind usage. Organizations are adopting AI agents, automation tools, and data-driven workflows faster than they can define access boundaries, policy enforcement, or accountability.

This gap is visible in the funding data. A notable share of companies categorized under GRC are positioning themselves not as traditional compliance tools, but as control layers for modern, AI-driven environments — addressing issues such as policy enforcement, auditability, third-party exposure, and identity sprawl. The clustering of capital into these vendors suggests that investors and founders alike see governance not as a back-office function, but as a prerequisite for scalable AI adoption.

Identity remains the control plane for modern risk

Identity continued to assert itself as a central pillar of cybersecurity investment. As cloud complexity, AI usage, and third-party access expand, identity increasingly functions as the primary enforcement point for risk management.

Rather than representing a standalone category, identity has long operated as a connective layer across cloud, data, fraud, and governance. What funding patterns in 2025 reinforce is not identity’s importance, but its role as the control plane through which modern security decisions are enforced — shaping access, accountability, and policy execution across the stack.

This framing helps explain why identity-aligned platforms continue to attract capital even as category boundaries blur and buyers prioritize outcomes over tools.

Fraud, OT/ICS, and critical infrastructure stay in focus

Digital fraud remains industrialized, even as individual attack vectors evolve. Investment in fraud prevention and detection reflects persistent pressure from financial losses, regulatory scrutiny, and reputational risk. Similarly, continued funding in OT/ICS and critical infrastructure security aligns with real-world incidents and heightened awareness of systemic exposure beyond traditional IT environments.

Budgets are rising but concentration is increasing

While overall cybersecurity spend continues to grow globally, budget growth at the enterprise level remains constrained. The result is spend concentration: fewer vendors, larger contracts, and greater scrutiny. This dynamic reinforces why platforms capable of delivering measurable outcomes — rather than incremental features — attracted disproportionate investment in 2025.

M&A Activity & Strategic Moves

M&A activity in 2025 reflected many of the same forces shaping funding. Strategic buyers focused on platform expansion, capability adjacency, and consolidation, particularly in areas tied to identity, AI-driven risk analysis, observability, and vertical specialization.

Rather than opportunistic roll-ups, most transactions appeared aimed at strengthening core platforms — adding control coverage, improving visibility, or accelerating time-to-value for enterprise customers. AI featured prominently in deal narratives, but rarely as a standalone rationale. Instead, it functioned as an enabling layer within broader security architectures.

This behavior reinforces a key takeaway from the funding data: scale without coherence is no longer rewarded. Both public and private acquirers are prioritizing assets that fit cleanly into an integrated security story.

Looking Ahead

2025 shaped up to be the strongest post-2022 funding year for cybersecurity vendors. But the capital is moving differently now. The volume is there but it’s increasingly being directed at:

- Early-stage vendors with credible teams and fast iteration

- Growth-stage platforms that offer cost consolidation or core control coverage

- AI-native startups where automation delivers real buyer value

As we move into 2026, we expect continued selectivity, increased diligence on go-to-market execution, and tighter alignment between budget allocation and board-level priorities.

Find our full list of transactions in our quarterly reports

Sources Referenced

Primary studies, reports, and official releases informing this analysis include research on digital identity market growth, AI governance and shadow identity risk, fraud and ransomware economics, OT/ICS visibility gaps, enterprise security budgeting trends, and board-level cyber risk prioritization. Where secondary articles were reviewed, underlying source material was traced and used preferentially.

Research Methodology

About Pinpoint Search Group

Cybersecurity innovators work with Pinpoint Search Group to identify, attract, and land professionals that enable maturation, scale, and successful outcomes. As start-ups continue raising millions in funding and established vendors make acquisitions to round out their offerings, Pinpoint Search Group is keeping track.

Contact us to discuss adding talent to your team, or if it’s time to explore new opportunities.