January's cyber security vendor transaction highlights

- 37 total funding and M&A transactions

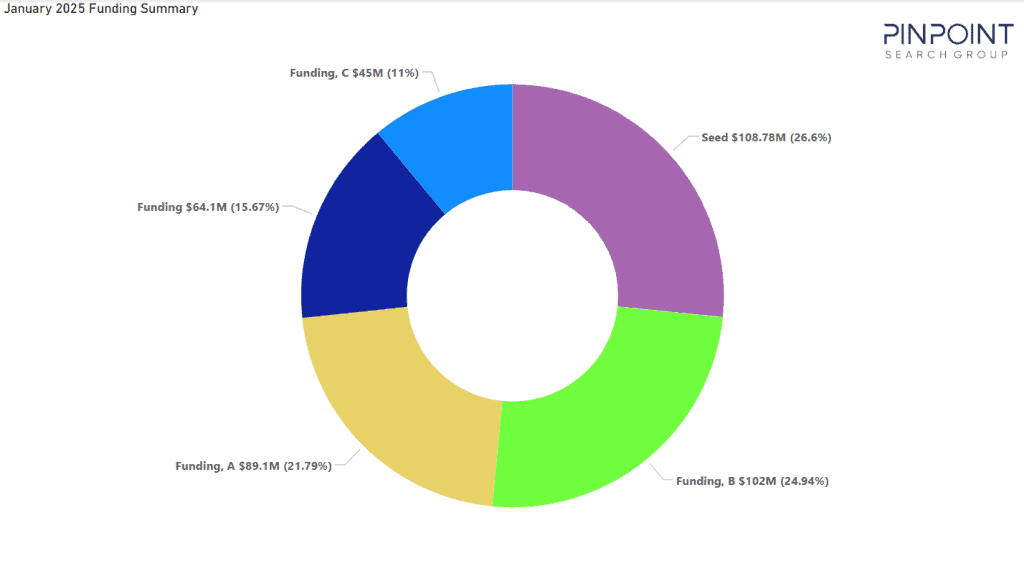

- $409 Million raised over 29 rounds

- 8 M&A events

Crunching the Numbers

- The $409 Million raised in January 2025 represents a 33% decrease in funding raised when compared to January 2024.

- 29 funding rounds were tracked in January ’25 compared to 17 in January, ’24.

- Early-stage funding (Seed, Series-A) represents 66% of all January 2025 funding rounds recorded.

January's funding round breakdown

January's funding rounds and mergers & acquisitions

Funding

M&A

Funding

| Vendor | Activity Type | Financials | Lead Investor | Market Segment |

| Orchid Security | Seed | $36,000,000 | Team8 | Identity |

| Wultra | Seed | $3,000,000 | Tensor Ventures | Quantum |

| AI or Not | Seed | $5,000,000 | Foundation Capital | Fraud |

| Spikerz | Seed | $7,000,000 | Disruptive AI | Fraud |

| DryRun Security | Seed | $8,700,000 | LiveOak Ventures | AppSec |

| Axoflow | Seed | $7,000,000 | EBRD Venture Capital | Detection/Response |

| Kymatio | Seed | $1,900,000 | Decelera | Training |

| TrustLogix | Seed | $13,000,000 | Westwave Capital | Data |

| Frenos | Seed | $3,880,000 | DataTribe | OT/ICS |

| Backline | Seed | $9,000,000 | StageOne Ventures | Vulnerability |

| Staris | Seed | $5,700,000 | Freestyle VC | AppSec |

| Freeze | Seed | $2,600,000 | Undisclosed | Vulnerability |

| Dune Security | Seed | $6,000,000 | Alumni Ventures | Training |

| ThreatMark | Funding | $23,000,000 | Octopus Ventures | Fraud |

| Zynap | Funding | $5,700,000 | Kibo Ventures | Threat Intel |

| Fudo Security | Funding | $9,400,000 | bValue Growth Fund | Identity |

| Almanax | Funding | $1,000,000 | Blockchain Builders Fund | Crypto |

| Conifers.AI | Funding | $25,000,000 | SYN Ventures | Detection/Response |

| SignPath | Funding, A | $5,100,000 | TIN Capital | AppSec |

| Dataships | Funding, A | $7,000,000 | Osage Venture Partners | GRC |

| Passbolt | Funding, A | $8,000,000 | Airbridge Equity Partners | Identity |

| Token Security | Funding, A | $20,000,000 | Notable Capital | Identity |

| Clutch | Funding, A | $20,000,000 | SignalFire | Identity |

| Seraphic | Funding, A | $29,000,000 | GreatPoint Ventures | Browser |

| BforeAI | Funding, B | $10,000,000 | Titanium Ventures | Threat Intel |

| Mitiga | Funding, B | $30,000,000 | SYN Ventures | Detection/Response |

| Hypori | Funding, B | $12,000,000 | UBS | Endpoint |

| Oligo | Funding, B | $50,000,000 | Greenfield Partners | AppSec |

| Eclypsium | Funding, C | $45,000,000 | Pavilion Capital | Firmware Security |

M&A

| Vendor | Activity Type | Acquiring Company | Financials | Market Segment |

| Phylum | Acquisition | Veracode | Undisclosed | AppSec |

| Trelica | Acquisition | 1Password | Undisclosed | SaaS Security |

| Cado Security | Acquisition | Darktrace | Undisclosed | Forensics |

| Alterya | Acquisition | Chainalysis | Undisclosed | Fraud |

| Kivu | Acquisition | Quorum | Undisclosed | Security Services |

| Vulcan Cyber | Acquisition | Tenable | $150,000,000 | Vulnerability |

| vArmour | Acquisition | Fenix24 | Undisclosed | Identity |

| Stack Identity | Acquisition | JumpCloud | Undisclosed | Identity |

Research Methodology

About Pinpoint Search Group

Cybersecurity and Space Economy innovators work with Pinpoint Search Group to identify, attract, and land professionals that enable maturation, scale, and successful outcomes. As start-ups continue raising millions in funding and established vendors make acquisitions to round out their offerings, Pinpoint Search Group is keeping track.

Contact us to discuss adding talent to your team, or if it’s time to explore new opportunities.